- Default welcome msg!

- Contact Us

- Create an Account

A Study with Nexium®

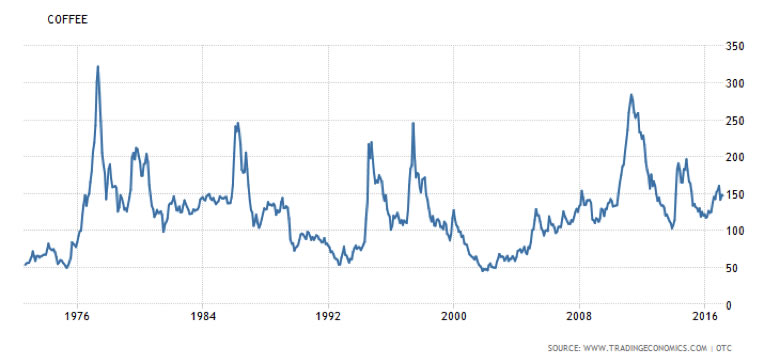

The study of coffee futures as an investment vehicle is fascinating and the results can be treacherous for those who attempt to ride the tiger of this soft commodity market. I have seen many in the roasted and the green coffee business lose their footing and be overwhelmed in a market turn. It is a fact that while green coffee has been traded in New York since colonial times, and in an organized “safe” fashion since the establishment of a coffee exchange in this city in 1882, there is, I think, with the exception of Abba Beyer’s, J.W. Phyfe & Co., only one extant green coffee importing house here that is over 30 years old. The enticement to play the market is so great that it sucks in even the experienced trader. The treachery and volatility of the market are so complete that it buries its devotees while they are still breathing.

The speculators and fund managers control the market, today; unlike when I was a boy and supply and demand were preeminent, and the largest roasters would, with their buying practices, determine when the market would spike. Arbitrage, realpolitik, and other factors often supersede weather, geothermal, and local political events in origin countries as drivers of price today. But, as in the past 150 years, above all is Brazil, and her sometimes booming, currently busting economy, her vast ability to produce beans, and her weather patterns, that are somewhat less than coffee friendly or predictable. It is an old Coffeeman’s adage, “When Brazil sneezes, we all catch cold.”

Following the market is interesting. Following differentials , the difference between what the market says that a middling Arabica grade coffee is worth on a given day, and the price for which you can actually buy a broken lot (less than 250 bags) of that item, or a specialty item on a given day, is as appealing and important as following the “C” contract. The specialty market, of course, continues its struggle to break free of the “C” through efforts as rating beans as wines, and internet auctions.

In the last decade there has developed a strong effort in the specialty community to get roaster buyers out to an origin land for a tour of local farms, as it is the feeling that bringing the roaster to the land, its people, culture and produce will bring added value to the beans offered. This de-commoditizing of coffee has had the hoped for effect. It has helped sensitize the roaster to the plight of the farmer, built personal relationships, added to the roaster’s knowledge, and added value to the beans, often all in the space of a week. For those who don’t make it to origin the seller offers a host of catch phrases, and jargon to enhance his offerings’ unique qualities, and so we hear about micro-climates, and micro-lots. The Brazilians first made dried-in-the-fruit coffee which they offer as “Pulp Naturals,” but the style of preparation was popularized by the Central Americans when they did the same thing and called it “Honey Coffee,” and thanks to the Peterson family of Hacienda La Esmeralda, in Panama, the word Geisha has become so hot in recent years, that you dare not touch it without a pot-holder, and deep pockets.

As a practical matter most independent roasters are too small to buy containers (250-284 bags) of coffee, and hedging with paper contracts, or puts and calls has proved to be beyond the understanding of many less sophisticated coffee businesspeople.

I have suggested to my fellows that to insure that they have coffee coming along, that they buy their bestselling origins in a pattern, fixing prices as they buy, between 8-20 weeks ahead of need. This idea when practiced religiously acts as a hedge by averaging costs, for a given item, over time. Other, less frequently purchased items may be obtained seasonally (Kona) or if generally available (Kenya) may be gotten on an as needed basis. Organics and decaffeinated varieties can usually be found as needed. Generally, but not always, as the market goes down differentials go up, as those at origin move to make up the lost ground in the market. The result is a perpetual partially hedged inventory.

Because markets move on after a purchase even though the coffee may not arrive for many weeks, a roaster’s inventory value is always a lagging indicator of coffee values, with the inventory being a mix of new purchase new arrival coffee, and older purchase new arrival coffee, and other points of price fix and arrival also in the mix. Roasters, not unlike stock traders in a bull market, also attempt taking advantage of dips in price to cover future needs at advantageous prices. Sometimes I am more successful at this than at other times, which is to be expected. It’s funny though that every roaster I talk to always says they caught the dip just right.

It is human nature that those at origin find it hard to give up wider differential margins as markets climb, and usually the margins do not adjust until buyers put pressure on the market by delaying their purchases, at which point a new equilibrium is found.

My old man made a point of complimenting my cupping and roasting skills, and would always end by reminding me that I had to be very careful when buying as I had a weak sense of market, and he feared that skill at the table and the roaster’s mouth would not save me, and Gillies, from bad timing in the green coffee market. Dad did very well anticipating the East coast dock strike of 1954. I did not anticipate the Black Frost of 1975 which effected values through 1997. I should have anticipated the great Brazilian drought of 1992-1994 which was caused by the moving north of Brazil’s coffee lands (to get them out of the frost belt) after the Black Frost had decimated Parana’s coffee 17 years earlier, but I did not. I also missed out on the panic that anticipated a Brazilian frost in 1997, that would drive “C” Contract prices over $3. The market was wrong that year, and I and many others were stung when frost hit in 1999. The old man was right about my sense of market.

I did not foresee the 2016 run-up in price from February to November, nor the fall back from November to January 2017, or the recent 25-cent February 2017 recovery. Fifty years of experience in this market does not appear to have taught me much. Wherever Dad is, he is laughing heartily. He loved his son dearly, He was also a man who enjoyed being proven “100% right.”

GREEN COFFEE PRICES

Image Source: http://www.tradingeconomics.com/commodity/coffee retrieved 02.24.17